So, you have a pension. That’s great news.

In fact, it is probably worth more than most 401-K plans.

How so?

First of all, your monthly retirement income is payable for as long as you live.

That could be a lot of money if you live long enough to collect it all.

More than $1 Million in fact.

But what if you don’t live long enough into retirement to collect all you have coming to you?

Fortunately, most pensions have an option that you can be selected at retirement where your benefits would continue to a named beneficiary should you not live long enough to collect all of your benefits yourself. It is a way to “insure” all the benefits that your pension has to offer.

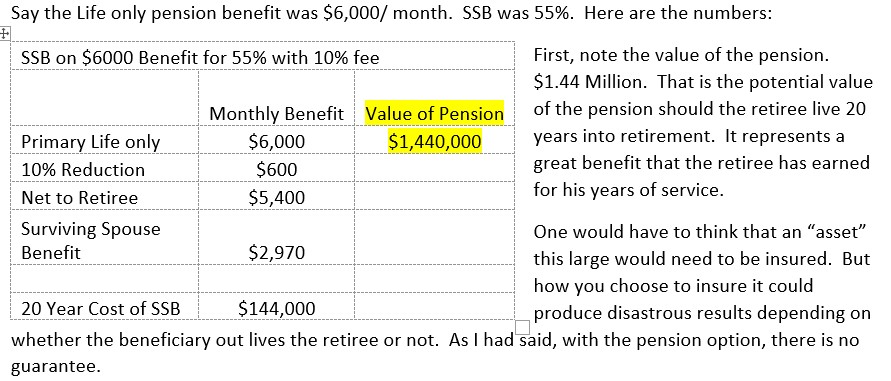

Unfortunately, there is a cost to selecting a Survivor option. It reduces your pension by 10% to 15% or more. It depends upon the age of the selected beneficiary. You can typically see these costs from your pension account online. There is a calculator showing this cost, typically. Additionally, your pension administrator can provide you with this information as well by contacting them.

WARNING! Selecting a survivor option through your pension can reduce your pension benefits by $100,000 or more and THERE IS NO GUARANTEE THAT ANYONE WILL RECEIVE A BENEFIT FOR THE MONEY YOU GIVE UP UNDER THIS OPTION. No guarantee, but why?

The Survivor Benefit option only pays a benefit if the selected beneficiary outlives the pension retiree. So, if the pension retiree lives 20 years into retirement and the selected beneficiary dies first in the 19th year, let’s say, there is no benefit for all the money the retiree gave up (paid). It’s all gone.

How much is gone. Probably in excess of $100,000 of the retiree’s pension. And what benefit did the retiree receive for this reduction? Maybe his beneficiary out-lives the retiree. If they live 10 years or longer than the retiree, that could have been a considerable benefit. But what if the beneficiary only out-lives the retiree a year or two; or heavens forbid the beneficiary dies first. Not such a good deal.

Here is an example:

But what if there was a better way to “insure” your pension, one that offered a Guarantee? We refer this to as Pension Maximation, sometime referred to SSB (Surviving Spousal Benefit) and it offers Guarantees that the pension option does not offer and can do it most time for no more cost, sometime even less.

How much less? Well, I need some information about your personal circumstances in order to generate a Pension Maximization proposal.

Click here to complete Pension Maximation Request. https://share.hsforms.com/1ghrTl4LSS_OGBLq7xwLXHAdrhzm

We will get back with you with the numbers.

Thanks

Dave Gilliland

Carrollton, TX 75007

GorillaRetirement.com

318-366-1699